|

|

|||||||

| Home | Rules & Guidelines | Register | Member Rides | FAQ | Members List | Social Groups | Calendar | Mark Forums Read |

| LOUD NOISES A place for political mudslinging, Pro/Anti legalization, gay marriage debate, Gun control rants, etc. If it's political, controversial, or hotly debated, it goes here. No regular Off-Topic stuff allowed. READ THE RULES BEFORE POSTING! |

|

|

|

Thread Tools | Display Modes |

|

|

#94 |

|

Philosopher King

|

There isn't enough of it to use as currency. It could possibly be used along with gold but I'm not sure how well that would work. Something to look into though.

__________________

G O L D E N B E A R R E P U B L I C |

|

|

|

|

|

#95 |

|

Post Whore!

|

How would you use gold as a currency? At $1300/oz, how would you carry $20 worth of gold? As recently as 2000, gold was only $237/oz. Does that mean we'd all magically have 6 times as much money now as we did ten years ago? It's a commodity. It's price fluctuates with the market, and has very little inherent value besides being shiny.

__________________

|

|

|

|

|

|

#99 | |||

|

Zilvia Addict

Join Date: Mar 2006

Location: Houston, TX

Age: 40

Posts: 713

Trader Rating: (5)

Feedback Score: 5 reviews

|

Quote:

By carrying a $20 dollar certificate that will be redeemable for the fixed quantity of gold. How do you think they did it in the past? You thought that people actually carried physical gold on their persons?  Quote:

Quote:

|

|||

|

|

|

|

|

#100 |

|

Zilvia Junkie

Join Date: May 2006

Location: San Antonio

Age: 32

Posts: 466

Trader Rating: (0)

Feedback Score: 0 reviews

|

What's to keep someone from using their gold certificates and then selling their physical gold before it is to be redeemed, all under a false name?

Besides there is not enough gold to distribute to over 300 million Americans, physically or not.

__________________

ShakotanOscar.blogspot.com |

|

|

|

|

|

#101 | ||

|

Zilvia Addict

Join Date: Mar 2006

Location: Houston, TX

Age: 40

Posts: 713

Trader Rating: (5)

Feedback Score: 5 reviews

|

Quote:

Quote:

Man I swear...  |

||

|

|

|

|

|

#102 | ||

|

Post Whore!

Join Date: Mar 2003

Location: New Jersey

Age: 40

Posts: 5,013

Trader Rating: (1)

Feedback Score: 1 reviews

|

Quote:

if we all bought gold in 2000, and if we all sold our gold right now, then yes, we'd all "magically" have almost 6 times as many dollars we did in 2000. that magic is called "investing." inflation between 2000 and 2010 was 27%. if we held a set amount of dollars in a box somewhere, those dollars would now "magically" have 3/4 times the amount of value they had ten years ago. where did it all go? those dollars the US government printed in the interim sucked the value right out of the box, your wallets and your bank accounts. i don't know about you, but i'd rather have 6x instead of 3/4x. similarly, if we held a set amount of gold as currency from 2000 to 2010 (and ignored the effect that would have on demand for gold and all that), then yes, in this very instant we'd have roughly six times the buying power we did ten years ago with the same amount of gold, due to artificially inflated demand for gold, (actually not quite 6x, based on the peg of 2000 and 2010 dollars to gold). why? that magic is simply the power of demand. that's also why you should fear the death of the dollar as the reserve currency of the world. having the dollar as reserve currency "artificially" drives up international demand for the dollar, giving it more buying power it would otherwise have. high demand things are worth more of other types of things. simple enough. Quote:

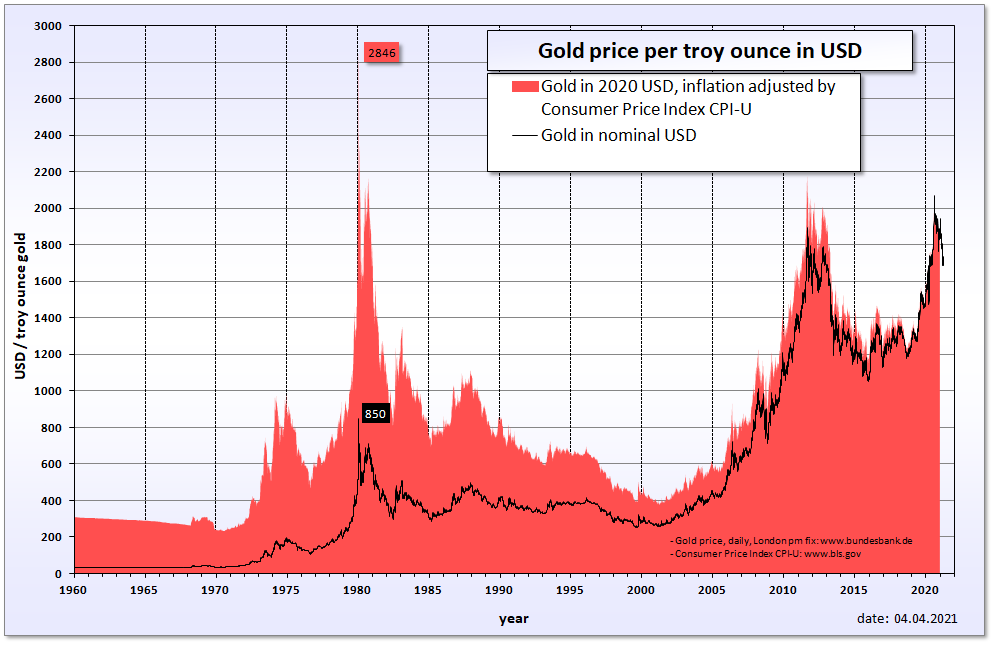

that doesn't mean gold can't bubble or crash. economic instability drives demand for gold up. if $237 in 2000 is worth $300 in 2010, you'd expect a steady priced commodity bought for $237 in 2000 to be worth $300 in 2010. but instead, gold is worth what, like $1300. however, that doesn't mean much from 2000-2010. at a minimum, you should be able to conclude quite easily that gold from 2000-2010 is clearly a superior store of wealth compared to dollar (and probably all fiat currencies). it probably would have been even without the artificial demand caused by the economic shitstorm. look at any super long term chart for value of gold; it's pretty obvious. that doesn't necessarily mean it's a good buy or a bad buy. in short term, it depends on the circumstances of the moment what you think is going to happen. in long term, its a hedge for people who already have alot of money. not people with mortgages and expenses. i wish i bought in 2008. my friend told me it was going to jump up, and i didn't believe him. I think it was at $750 or so at that point. he bought in. he held, i told him it was going to drop, and he should sell. he told me to stfu. he said it was going to crest $1000. i think he sold at $1100/oz or so on something like 50oz. 50 x $350 sick ROI. he held it less than two years. i didn't believe them. now it's at fucking $1300, lol. almost double its value in less than 3 years, and i missed out on all of it. good thing i'm not an investor. |

||

|

|

|

|

|

#103 |

|

Zilvia FREAK!

Join Date: Aug 2005

Location: Orange Park, FL (Jax)

Posts: 1,468

Trader Rating: (0)

Feedback Score: 0 reviews

|

There are several points in this discussion that are well founded and several that are pure speculation.

There are several things to point out that no one has addressed in this issue. While the populace struggles throughout the history of this nation with national banks, currently there is zero chance for this nation to goto the gold standard. It is important to understand the structure of our monetary policy. The "Federal Reserve" is a privately owned corporation. IT IS NOT PART OF THE GOV'T! It is a privately traded company with many of the main share holders, some of the richest families in the world who intend to get richer. The gov't does not control it's own currency. It sold it. I should also point out that the founding fathers thought a national bank would be detrimental. Andrew Jackson struggled with national banks again later. Merchants wanted the borrowing power, banks crushed the common person though. The Fed is bound by law to "promote policies for economic growth" but there is no lash to enforce that rule. There are zero auditing powers on the fed. Congress, the president, etc can not see what the books are like on our own currency. They must believe the statements given quarterly. Currently the fed is printing money like it's going out of style to purchase treasuries from the gov't to finance their own debt. It costs them about 4 cents to print $100. Currently they are buying $100 for .0004% of face value. It's using inflationary practices to fight out of control debt spending. Essentially utilizing your credit cards to pay your credit cards even after the card companies lowered your rate to 2%. Keep in mind we don't actually make a minimum payment. We struggle to just make the interest payment. No real progress towards the balance is ever made or has ever been made in 70 years. If we were on the gold standard, it keeps prices stable but prevents a "global" economy. If you look at the american worker this "global economy" was supposed to be a good thing providing cheaper imports. Unfortunately that resulted in all their jobs being exported as well. A slight ooops. To put america back on the gold standard, it would almost have to pay off the national debt. That or to counter act the massive debt and the lack of gold reserves, you would need to devalue the dollar by 90%. There's just THAT MUCH DEBT!. Americans would be beyond broke but have incredible price stability. I believe that if the gov't sat down and "came clean" they'd realize that it's almost impossible for them to dig themselves out of the hole. You would need about a 10% tax hike with a 25% decrease in spending. With that, in 20-30 years, we'd pay it off. Any policy that doesn't involve tax hikes and cuts in spending is a hand job. That or go through a period of hyperinflation to render the dollar meaningless along with the debt. When you stare at the debt clock and it says your families share is 100k, well they've got to tax 100k out of you and get it. If we are going to make predictions, obama's economic "dream team" is going to suggest a minor 3-5% VAT tax which will "fix the budget". This will now become the "goto" tax for money and be at 10-12% in 10 years after it's passed for various reasons. The only way to fix this mess is to strangle the tax dollars coming in and make them pay out less and save their way to financial freedom. Tossing more money at them will not fix the problem.

__________________

Eye on the Prize |

|

|

|

|

|

#104 | ||

|

Zilvia Addict

|

Quote:

can one of you pro-gold std people read Globalizing Capital by eichengreen or here... let me google him for you globalizing capital eichengreen - Google Scholar killburn and company, do some research, learn something and then get back to the party... this article looks juicy Global imbalances and the lessons of Bretton Woods - Cairn.info DONE

__________________

Quote:

|

||

|

|

|

|

|

#105 |

|

Philosopher King

|

Don't let the door hit you . . .

It is great to see others agreeing with me here on Zilvia. It really felt like I was getting jumped by ignorance incarnate. I mean I don't mind if people do disagree with me but at least be informed on the topic and don't just throw fallacies and ad hominem arguments out there.

__________________

G O L D E N B E A R R E P U B L I C |

|

|

|

|

|

#106 | ||

|

Zilvia Addict

|

Quote:

__________________

Quote:

|

||

|

|

|

|

|

#107 | |||||||||

|

Post Whore!

|

Thanks for CONTRIBUTING something new.

Quote:

Quote:

If you prefer a more market based transition, then there isn't enough gold in the world either. There is over $8 Trillion US dollars currently in the world. How is the US governement going to buy enough gold to back that many dollars? And, once the government starts buying gold, then the price of gold starts to skyrocket. Quote:

Quote:

Yeah, I was joking around there. Quote:

Quote:

Quote:

Quote:

Quote:

Compare that to the S&P 500 for the past 50 years.

__________________

|

|||||||||

|

|

|

|

|

#108 | ||||

|

Post Whore!

|

Forgot to multi-quote this one.....

Quote:

Quote:

Quote:

Quote:

__________________

Last edited by axiomatik; 10-06-2010 at 02:21 PM.. Reason: accidentally typed billion instead of trillion |

||||

|

|

|

|

|

#109 | |

|

Philosopher King

|

When we used the gold standard there was enough gold that if every one cashed in their gold certificates every one got what they were owed.

It's funny that in the pictures you posted the two spikes in price are also the two lowest points in the value of the dollar. Coincidence? THE reason the value of the dollar is tanking is because they are printing BILLIONS of dollars every year. They are making money where there was non before. Every dollar printed devalues the rest. Quote:

__________________

G O L D E N B E A R R E P U B L I C Last edited by kingkilburn; 09-29-2010 at 12:59 AM.. |

|

|

|

|

|

|

#110 | ||||

|

Post Whore!

|

Quote:

Quote:

Quote:

There is no single set "value of the dollar". Quote:

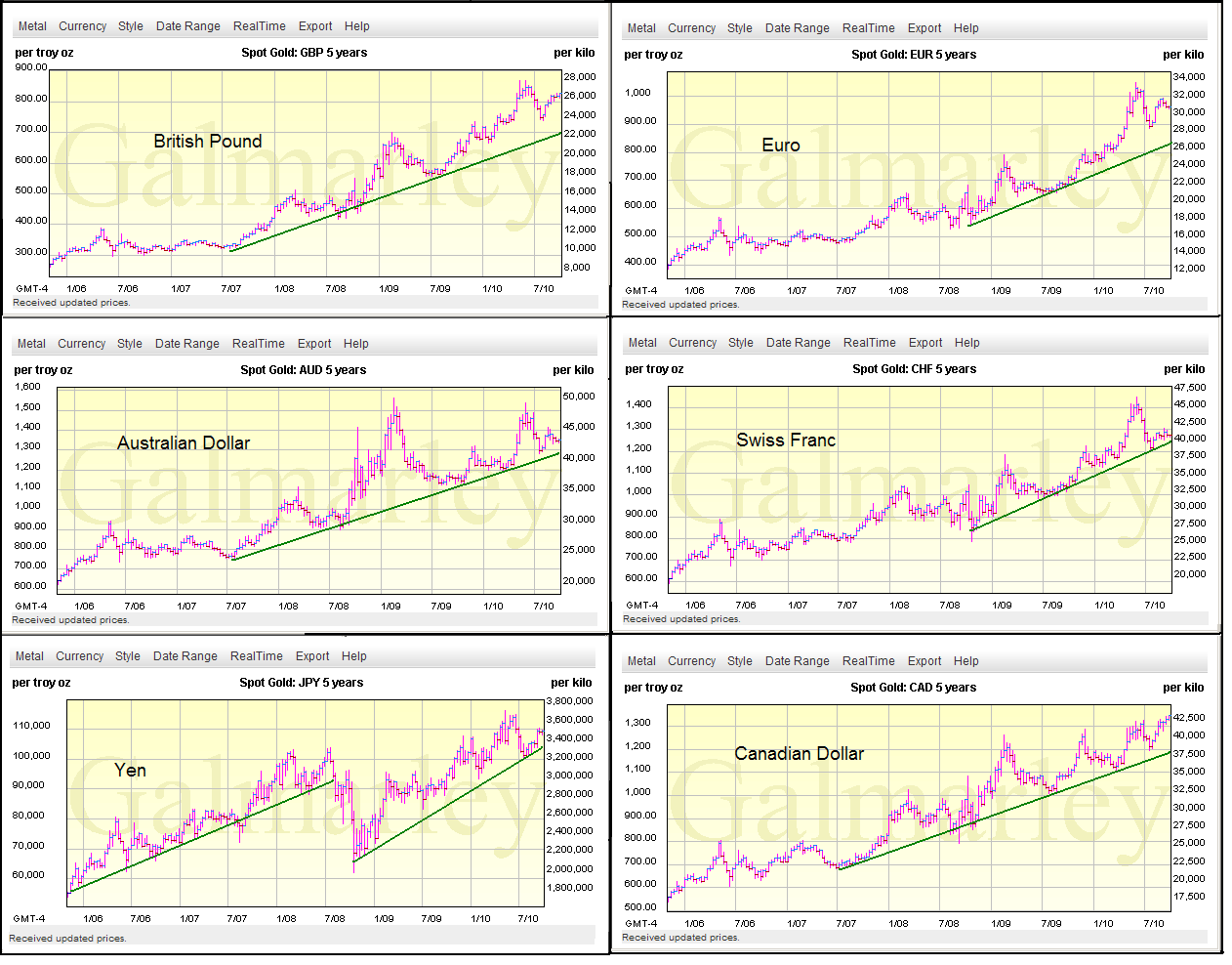

If you look at a graph of the dollar versus the Euro, the dollar is now stronger than it was back in late 2007 when 1 EUR = $1.55 (roughly). Currently it's at ~$1.35 and as recently as this past June 1 EUR was only worth $1.20. (I can't find a good static graph of the dollar versus the euro, everything I found in my quick search is either outdated or a dynamic graph) Here is a graph of the price of gold versus 6 other currencies. As you can see, the price of gold is way up across the board.  Neither did I.

__________________

|

||||

|

|

|

|

|

#111 | |||||

|

Philosopher King

|

Quote:

Quote:

Quote:

Quote:

Quote:

__________________

G O L D E N B E A R R E P U B L I C |

|||||

|

|

|

|

|

#112 |

|

Post Whore!

|

You are arguing that because the Fed is increasing the money supply, the 'value' of the dollar is plummeting, and that this wouldn't happen if we were on the Gold Standard. However, this summer the dollar was stronger versus the euro than it had ever been since 2005.

__________________

|

|

|

|

|

|

#113 |

|

Philosopher King

|

The Euro also fell pretty hard with all the financial troubles going on over there. It costs a lot to literally buy out the debt of a country, even if it's a small one.

__________________

G O L D E N B E A R R E P U B L I C |

|

|

|

|

|

#114 |

|

Nissanaholic!

Join Date: Nov 2004

Location: Alberta, Red Derp

Age: 40

Posts: 1,729

Trader Rating: (0)

Feedback Score: 0 reviews

|

best foolproof investment is food commodities. (and owning some of your own farmland and contract it out to neighbor farmers)

reason 1) world expands, more people = more need for food = less land to grow it on reason 2) in worst case senereo where money is worth $0, so is every 'precious metal', and those with food will always provide for family, and have the ability to trade for other goods and services at face value. reason 3) food is the no1 necessity for every living being... 2nd comes shelter.

__________________

KA-T  ORG-Function over Flush ORG-Function over Flush

|

|

|

|

|

|

#115 |

|

Philosopher King

|

Even in a barter system precious metals still hold value.

How do you think gold and silver became valuable in the first place?

__________________

G O L D E N B E A R R E P U B L I C |

|

|

|

|

|

#116 | |||||

|

Post Whore!

|

Quote:

Quote:

Quote:

Bank of Japan Moves to Buy More Assets Japan is working on driving down the value of the yen. Quote:

more on deflation: NY Times: Deflation Quote:

__________________

|

|||||

|

|

|

|

|

#117 |

|

Post Whore!

|

Because it is pretty. Gold especially was revered in ancient times for it's apparent magical ability to never tarnish or rust. Not because it is useful.

__________________

|

|

|

|

|

|

#119 |

|

Philosopher King

|

Keynesian economics - Wikipedia, the free encyclopedia

Rather than try to poke semantic holes in my claims maybe you should learn more about what you have been trying to use to back up yours. Wikipedia is as good a place as any to start.

__________________

G O L D E N B E A R R E P U B L I C |

|

|

|

|

|

#120 | |

|

Post Whore!

|

Quote:

You keep saying that the value of the dollar is plunging, and when I ask for evidence (and provide counter-evidence), your response is basically "it just is". You have claimed in this thread that since the US went off the gold standard, the value of gold has just kept rising. I have provided counter-evidence to that as well. Even adjusted for inflation of the dollar, the value of gold steadily declined between 1980 and ~2003. That is almost a quarter-century of declining value. The rise in value of gold is a very recent phenomenon. Not only that, but it is very similar to the run-up in the price of oil. The stock market isn't doing so hot, so people invest in gold. The price of gold goes up as a result, and other people see the price increase, so they invest in gold to get an ROI, further driving up the price of gold. Eventually, there is going to be a massive drop in the price of gold as investors start to believe that it is over-priced (and hence, future gains will be minimal) and turn back to the stock market for investment. As people cash out of gold, the price will drop. As I have mentioned before, and which you have ignored, the real concern for the value of the dollar is not what the Fed is doing, but America's trade balance. Every year that we run a trade deficit, we increase the global supply of US dollars. The more US dollars outside of our borders, the less it will be worth relative to other currencies. Here is a fantastic graph of the US trade balance and global reserves of US dollars:  As you can see, up until 1992, the US trade imbalance wasn't too bad, and in fact was improving in the late-80's/early-90's. Since 1992, however, the US trade deficit has grown exponentially. This is due to a number of factors. First, the obvious, outsourcing of manufacturing to China and other low-cost countries. While the US is still the #1 manufacturer in the world, we are quickly exporting our manufacturing industry, especially for low-priced goods, but increasingly for high-tech, high-value industries. How many computers and related components are built in the US anymore versus Taiwan and China? How about chip fabs? The second large factor in our trade balance is the importation of oil. The US hit peak domestic oil production in the early 1970's, and domestic production has been falling ever since.  However, our consumption has only increased. That, coupled with the rising cost of oil due to the higher demands in emergent economies such as China, India etc, is driving up our trade deficit. Crude oil is currently trading at ~$80/barrel. If we look at the last data in that graph, we imported around 10 million barrels a day in 2005. That's $800 million dollars a day, $24 billion dollars a month, and almost $300 billion dollars a year. To me, that is the biggest concern for the value of the dollar. We are spending $300 billion dollars a year to buy oil from other countries. That's $300 billion dollars of our wealth exiting the country. Every year. And that money is expanding the global supply of US dollars. That is why on the graph above, global reserves of US dollars have climbed to $7 Trillion dollars, because we keep importing more goods than we export. And that isn't going to change unless we can get our oil consumption under control. Going onto the gold standard is not going to help us if we continue to buy $300 billion dollars of oil every year. Because if those foreign entities holding dollars choose to cash in for gold, what are we going to do? We will only have a finite amount of gold. If we try to purchase more gold on the global market, what happens if that currency is cashed in? The gold standard would only work if our trade balance was neutral, positive some years, negative other years. But as long as we run astronomical trade deficits, the gold standard is unworkable.

__________________

Last edited by axiomatik; 10-06-2010 at 12:43 PM.. |

|

|

|

|

|

| Bookmarks |

| Thread Tools | |

| Display Modes | |

|

|